Roth ira expected rate of return

A good rate of return for a Roth IRA is about 10 which is the average annual return of the SP 500. Get Up To 600 When Funding A New IRA.

What Is An Average Roth Ira Return Smartasset

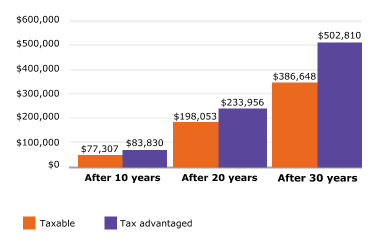

The annual rate of return is the amount the investments in your Roth IRA make in a year.

. Roth Ira Expected Rate Of Return Overview Roth Ira Expected Rate Of Return A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains. As of March 2022 the national average interest rate offered on savings accounts. Home financial roth ira.

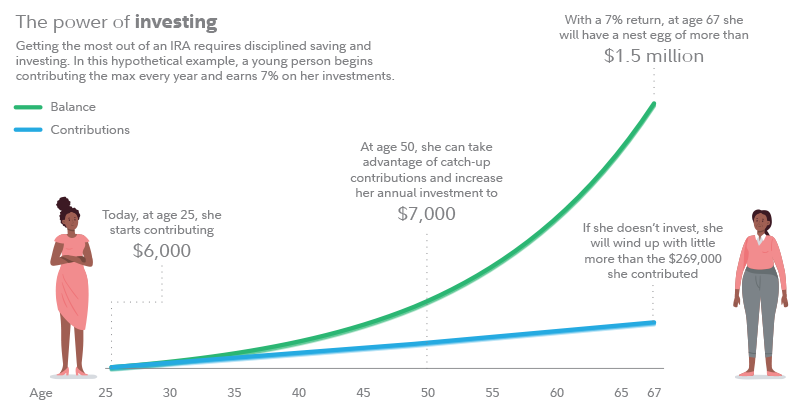

Learn About 2021 Contribution Limits. The actual growth rate will largely depend on how you invest the underlying capital. Expected Rate of Return This is the annual compound rate of return you anticipate receiving on your Roth IRA savings.

Ad Dont Wait - Get Started Now. So assuming youre not about to retire next year you desire development as well as concentrated investments for your Roth IRA. Average Expected Rate Of Return On Roth Ira A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable.

Roth IRA Expected Rate Of Return. Ad Roll Over Into a TIAA Roth IRA Get a Clearer View Of Your Financial Picture. Marginal Tax Rate in Retirement.

Save for Retirement with Convenient and Flexible Fund Choices. Assuming a starting balance of 5000 annual contributions of 5500 current age of 29 retirement age of 65 marginal tax rate of 32 percent and expected rate of return of 7. This will vary from person to person based investing strategy fees.

Roth IRA After Tax Regular Taxable Savings After Tax Age. The Sooner You Invest the More Opportunity Your Money Has To Grow. Fund Your IRA Start Pursuing Your Retirement Goals Today.

Ad Find A Roth IRA That May Be Right For You. Determining Rates of Return. Thats what long-term buy-and-hold investors can expect to earn over time.

Explore Choices For Your IRA Now. Get Up To 600 When Funding A New IRA. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

Learn About 2021 Contribution Limits. Current Marginal Tax Rate. Reviews Trusted by Over 45000000.

Ad Find A Roth IRA That May Be Right For You. So assuming youre not ready to retire following year you want growth and also concentrated investments for your Roth IRA. Expected Rate Of Return Roth Ira A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the value of.

The stock markets average return over the long term is about 10 annually. Expected Rate Of Return On Roth IRA. Compare 2022s Best Gold IRAs from Top Providers.

Calculating Expected Rate of Return. The rate of returns is not likely to keep up with inflation rates meaning you could lose money. Save for Retirement with Convenient and Flexible Fund Choices.

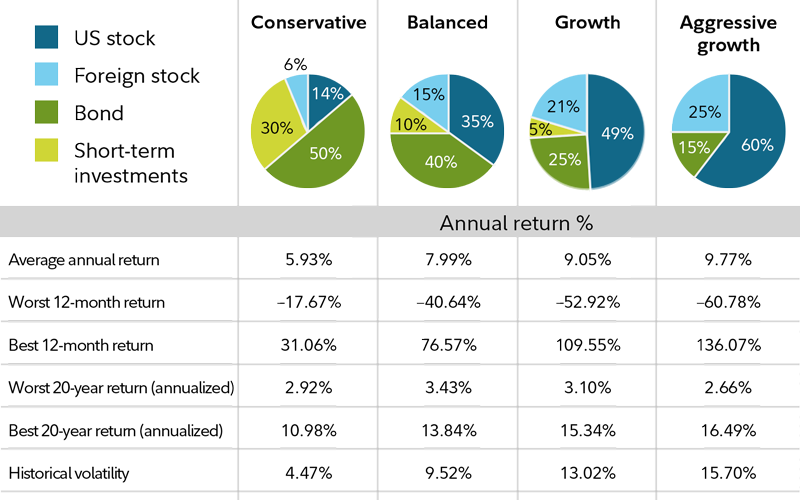

The Roth IRA calculator defaults to a 6 rate of return which should be adjusted to reflect the. Thinking youre not around to retire next year you desire growth and also concentrated investments for your Roth IRA. Simply put you intend to.

To put it simply you want. However as you get closer to retirement a good rate of return may be. Can expect anywhere between 7-10 average annual returns.

Expected Rate Of Return Roth IRA. Free inflation-adjusted Roth IRA calculator to estimate growth tax savings total return and balance at retirement with the option to contribute regularly. Ad Explore Your Choices For Your IRA.

Invest Your Ira Tax Tips Fidelity

:max_bytes(150000):strip_icc():gifv()/Term-Definitions_capm_FINAL-f0f4b778e9d34c3296999cc8a8690ca7.png)

Capital Asset Pricing Model Capm And Assumptions Explained

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

/returnonequity-v1-1cd72f9606e54be085ea56eb866cc9c4.png)

Return On Equity Roe Calculation And What It Means

What Dollar Cost Averaging Did In The Lost Decade Novel Investor Lost Decade Investment Quotes Dollar

Pin On Good To Know Stuff

What Is An Average Roth Ira Return Smartasset

Pf101 Intro To Personal Finance Goals Finance Class Finance Goals Cash Flow Statement

Pin On Investments Taxes Money

Roth Ira Calculator How Much Could My Roth Ira Be Worth

How To Invest Your Ira Fidelity

/dotdash_Final_Inflation_Adjusted_Return_Nov_2020-01-c53e0ae26e8f404fb1ce91a9127cbd3b.jpg)

Inflation Adjusted Return Definition

Contributing To Your Ira Start Early Know Your Limits Fidelity

Form 1040 Income Tax Return Irs Tax Forms Tax Forms

Ira Information Types Of Iras Traditional And Roth Wells Fargo

Pin On Taxes